Business Insurance in and around Erwin

Calling all small business owners of Erwin!

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

When you're a business owner, there's so much to focus on. We understand. State Farm agent Brian Poston is a business owner, too. Let Brian Poston help you make sure that your business is properly protected. You won't regret it!

Calling all small business owners of Erwin!

Almost 100 years of helping small businesses

Insurance Designed For Small Business

If you're looking for a business policy that can help cover buildings you own, business property, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

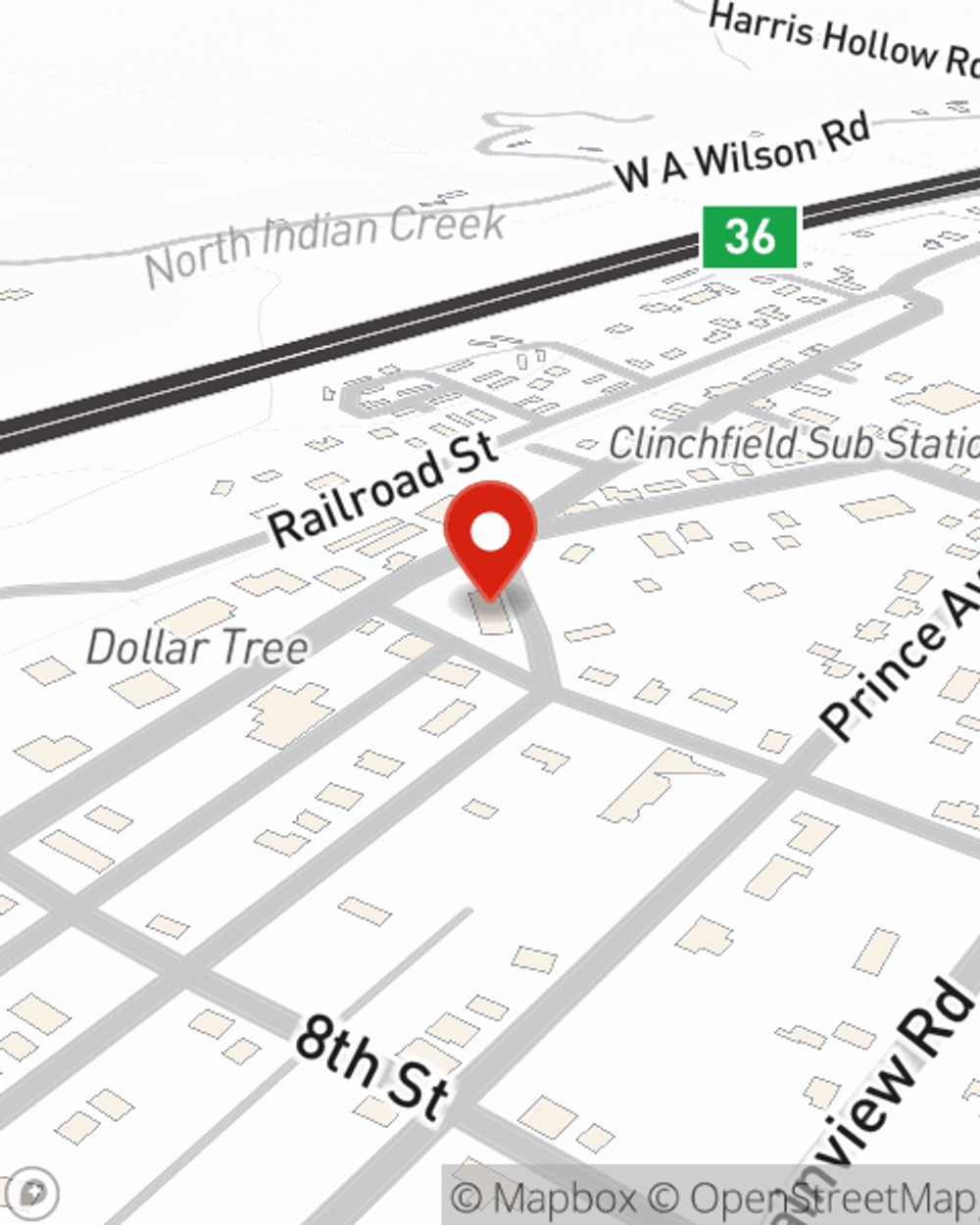

Call or email State Farm agent Brian Poston today to find out how a State Farm small business policy can safeguard your future here in Erwin, TN.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Brian Poston

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.